Entrepreneur looking for successor

In recent years, many SME companies have been sold and achieved top prices. Matthias Ehnert knows the background and answers our questions.

Matthias Ehnert is the managing director of the consultancy intelligentis GmbH and a specialist in company sales in the lift market.

What is the current state of the lift industry? Why are so many companies being sold?

Matthias Ehnert: The lift market is a so-called oligopoly, heavily dominated by the Big 4 of the industry - Kone, Otis, Schindler, ThyssenKrupp Elevator. However, apart from them, there are many small and medium-sized companies with a market share of about 40% in Germany – and declining. This is because the big players in the industry, with their well-filled wallets and thanks to the attractive interest rates, are on a buying spree. But SMEs are buying too. The M&A market for lift companies is currently a "seller’s market," i.e.: well-established SME companies are in demand and can be sold at top prices by their owners.

Will a lot of companies be sold on the lift market in 2018 too?

Ehnert: Yes, because on the one hand there are potential buyers with a lot of liquidity and on the other a multitude of company owners looking for a succession solution, but who don’t want to or can’t pass on their company inside the family. They’re looking for an external buyer, but this can’t by any means always be a global player. Strategic purchases by SMEs or takeovers by private individuals are likewise successful transfer models. Small companies with specialised personnel or long-term maintenance packages are attractive to SME buyers and their owners should make long-term preparations for selling the company. In this way, closing the company on the grounds of age can be avoided and liquidity ensured in future for the continued existence of their life work.

How will the price level at which companies are sold develop?

Ehnert: Company value and the later selling price of a company are naturally highly individual. But in general terms, I wouldn’t speculate on valuations increasing beyond 2018. This is because the companies that dominate the market have already made huge investments in R&D and digitalisation. Just think of the Thyssen test tower in Rottweil and the Schindler technology campus in Berlin. They are already very well set up in terms of technology and patents, efficient manufacturing, automation and digitalization of their processes. This could curb the interest of the major players in additional purchases and lead to falling valuations, which would then in turn affect transactions of all kinds in the industry.

What would you advise entrepreneurs interested in selling their companies in the medium term – wait and see or sell quickly?

Ehnert: Neither biding your time nor acting under pressure are good companions. Company owners interested in selling to a successor in the next few years should already calmly be taking the first steps in the sales process, becoming clear about their goals, reducing dependencies and identifying factors that boost the purchase price. I advise against going it on one’s own.

Why?

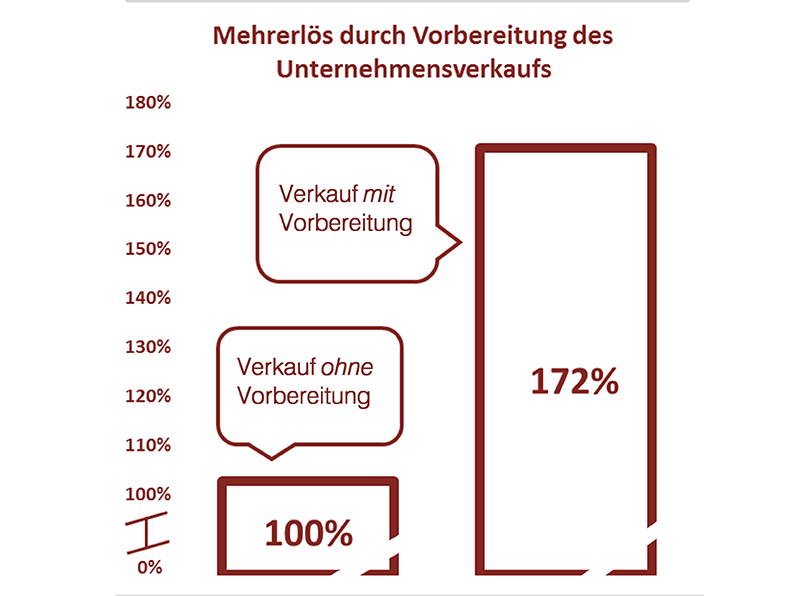

Ehnert: Selling a company is complex – both for buyers and sellers. Company values must be properly assessed, the correct strategies determined and legal conditions checked. Advisors commissioned by the seller help to process strengths and weaknesses and in this way optimise the company value. That should of course happen before the company is officially offered for sale. To this extent, the owner should allow for at least a year's lead time and get professional advice. Only in this way can it be ensured that entrepreneurs can transfer their lives’ work successfully and on appropriate conditions without having to neglect day-to-day business during the sales process.

What potential buyers would an M&A specialist contact?

Ehnert: Strategic investors from among the global players and the SMEs are potential buyers in the lift industry. On the other hand, there are financial investors who are prepared to acquire majority or minority shares in lift companies. For example, apart from private equity funds, all kinds of family offices are looking for holdings to invest private fortunes in growth markets. Moreover, long-standing, experienced employees from companies in the industry are often interested in becoming their own bosses through company purchases. The M&A advisor analyses which of these investor groups is to be addressed during sale preparation phase. Discretion is naturally a top priority during the entire process.

Is confidentiality observed in this regard?

Ehnert: The specific company name is only communicated very late in the process – only after anonymised company information and confidentiality agreements have been exchanged, potential buyers analysed and approved by the seller for contact and these investors have confirmed the credibility of their interest in buying. Confidentiality is extremely well-preserved through cooperation with sales specialists whereas it is often endangered from the start in self-sales, due to the lack of know-how.

What else makes a self-sale a bad idea?

Ehnert: According to statistics, 70% of all self-sales fail. Usually due to exaggerated purchase price expectations of owners, unprocessed weaknesses in the company, guarantee demands, psychological tricks like last-minute price discussions and not infrequently due to payment modalities. The current flood of successor requirements also impairs a self-sale. Along with the emotionality that owners naturally bring to the sale of their life work, but which often impairs objective conduct of the negotiations. The desire to sell quickly makes the rounds in the industry after an abortive self-sale or contacting a buyer. Normally, this leads to a fall in price in the event of renewed sales attempts or even to reputation problems in day-to-day operations in the event of further conduct of the business.

Consequently, sellers need an experienced partner at their side guiding the sale process, discovering potential, eliminating hindrances and providing advice relating to company value, marketing and processes, including asset management. And who is paid according to results, i.e. who has the same sales price interests as the company owner. In my opinion, this is the only way company owners can transfer their life's work at a satisfactory price and by means of a good process to a successor.

www.intelligentis.de

Write a comment